Money

Scared of investing your money but kinda curious? This chat is for you

Published by Bella Holt

11 Jul 2025

Let’s be real, most of us know we should be doing something with our money, but the word ‘investing’ still feels like it belongs in a finance bro’s podcast or the final round of a really hard pub quiz.

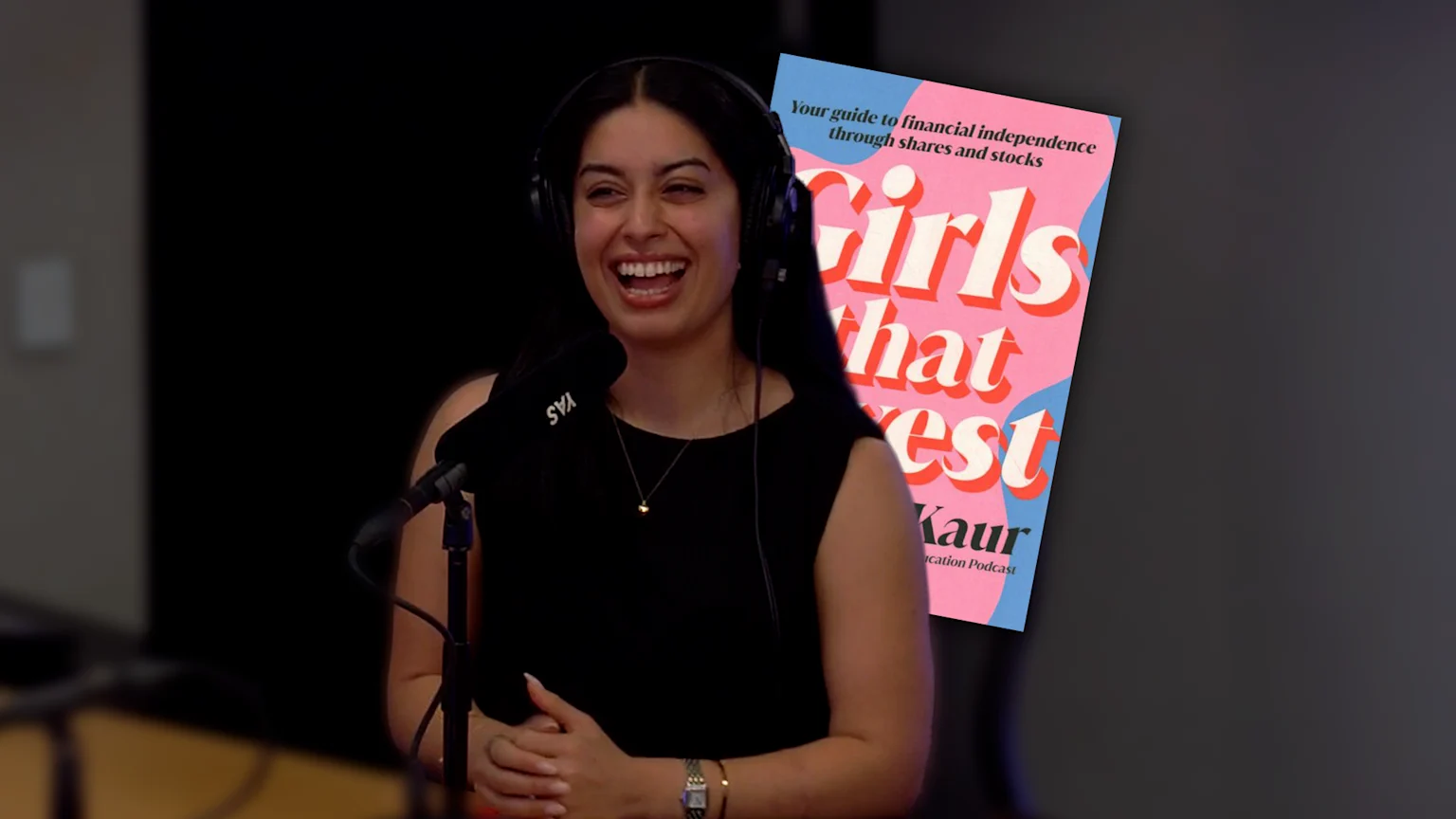

But in a refreshingly relatable chat on The Edge Breakfast show, Sim from ‘Friends that Invest’ (formerly known as ‘Girls that Invest’) broke it all down, and for once, made it make sense.

If you’ve ever wondered what investing is, how people make money from it, and why it’s any different from just chucking your money in a savings account, this one’s worth a watch.

And don’t worry, it’s all explained in plain in very basic terms, with a side of skincare, mortgage hacks, and surprisingly useful shirt analogies.

So, how does investing even work?

The team kicked off with the basics: When you leave your money in the bank, it earns a tiny bit of interest, but that’s only because the bank is turning around and using your money to make their money - usually, by lending it out at a much higher interest rate.

Sim explained it perfectly:

“You give them $1,000 and they give you 2% interest. But then they lend that money out for 7%. So, where does the other 5% go? Into the bank’s pocket.”

Investing just cuts out the middleman. Instead of the bank using your money to make gains, you put your money directly into companies by buying shares. When those companies grow and succeed, your money does too.

The risk factor

There was a lot of chat around risk, the part that puts most of us off. But the key takeaway? The longer you’re investing for, the less scary it becomes.

“The market goes up and down… COVID, financial crises, interest rate hikes,” Sim said. “But when you zoom out over 10 or 20 years, the trend is usually up.”

And when things dip? Don’t panic. “You haven’t actually lost money unless you sell,” she explained. So pulling your investment when it’s low is the real loss, not the dip itself.

Clint used a great analogy: It’s like buying a shirt at full price, then returning it when it’s on sale and only getting the discounted amount back.

“Just because something is currently worth less, doesn’t mean it always will be,” Sim added.

Where to start?

If the idea of picking companies to invest in feels overwhelming (fair), Sim recommends starting with a fund.

“A fund is like a basket filled with lots of different companies,” she said. One of the most popular is the S&P 500, a fund made up of the top 500 public companies in the US.

“Your money’s spread across them all, so if one flops, the others can carry the weight.”

Still nervous? Most platforms (like Sharesies or Hatch) show you a 1 to 7 risk rating for each option, so you can choose what matches your comfort level.

So if you’ve been waiting for a sign to start taking charge of your money… this is it. Watch the full convo below!

Published by Bella Holt

11 Jul 2025